Hong Kong debt levels double in a decade as property boom takes its toll

South China Morning Post

Raymond Yeung

21 November 2016

Hong Kong’s households are nearly twice as much in debt as they were a

decade ago, with grass-roots families earning less than what they spend

every month, research by the city’s legislature has found.

A survey released by the Legislative Council research office on Monday

also revealed retirees’ inability to support themselves solely with

their Mandatory Provident Fund pension savings, emphasising a need to

accumulate “substantial” retirement money to live without financial

assistance.

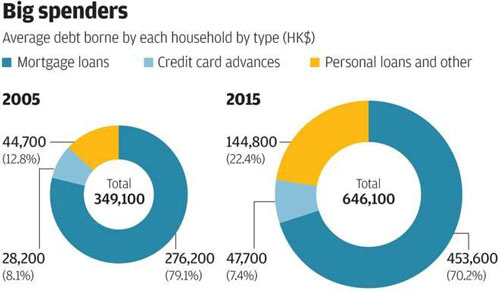

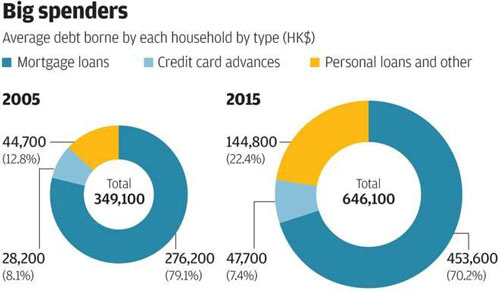

In 2005, the average debt borne by each household, comprising

mortgages, credit card advances and personal loans, was HK$349,100.

That amount nearly doubled to HK$646,100 last year.

Overall, the outstanding balance of household loans was HK$1,594

billion, 70% in the form of mortgages, more than twice the amount a

decade ago.

Legco’s report acknowledged the importance of having savings to deal

with emergencies such as unemployment or illness, as well as reducing

society’s reliance on social welfare. “However, in face of slowing

economic growth, slackening social mobility, continued inflation and

escalating property cost in Hong Kong, many lower- to middle-income

families may not be able to do so,” researchers noted.

Citing the latest data from the Census and Statistics Department, the

report estimated that the average household expenditure in 2015 was

HK$27,600 per month, representing a 46% rise from a decade ago.

The amount of savings was less for lower-income households. Those with

incomes of HK$11,000 to HK$16,000 per month could not earn enough to

cover their basic expenses, having to fork out an additional HK$400.

This was in stark contrast to the HK$23,700 saved by households with a monthly income of HK$61,000 to HK$85,000.

Housing accounted for the bulk of spending, taking up 36 per cent of monthly expenditure.

Flat prices and rentals surged by 223% and 100% respectively between

2005 and 2015, forcing many to resort to taking out bigger mortgages.

The average monthly expenditure of a retired couple last year ranged

between HK$6,600 and HK$38,300. But their MPF benefits averaged at

HK$144,000, which could only cover less than two years of spending.

Even with relatives helping by contributing an average of HK$4,500 a

month, retirees still needed considerably more to be self-sufficient.

top contents

chapter previous

next