| MTCC No. 744 v. Bazilinsky (The case of the missing parrot) |

| MTCC No. 1067 v. 1388020 Ontario Corp |

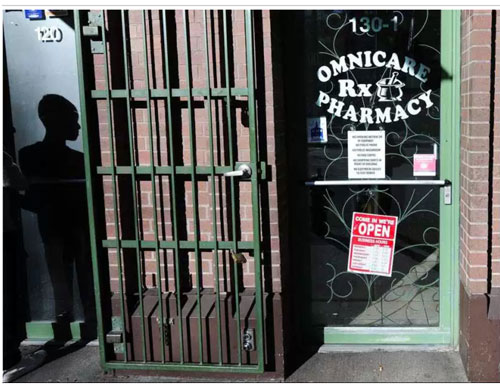

| BC: Downtown Eastside pharmacy fined 'unfairly' by strata (condo) |

| Keeping the lien window open |

| (a) |

“Arrears of payments required to be made under the provision of this Article XI shall bear interest at the rate of thirty (30%) percent above the prime rate charged by the Toronto Dominion Bank to its best risk commercial accounts per annum and shall be compounded monthly until paid and shall be deemed to constitute a reasonable charge incurred by the Corporation in collecting the unpaid amounts within the meaning of the Act.” |

| (b) |

In addition to any other remedies, the Board may bring legal action on

behalf of the Corporation to enforce collection thereof and “they shall

be added to any amounts found due, all cost of such action, including

cost as between a solicitor and his own client”. |

| $ 3,136.32 | costs of compliance letters written by condo’s lawyers to the owner. |

| 1,659.82 | accrued interest. |

| 9,562.50 | legal costs in respect of the lien and attempted collection of arrears. |